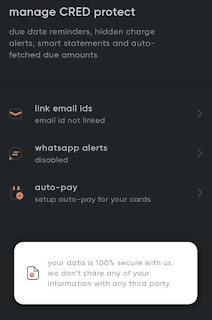

CRED protect is an AI backed optional feature that is offered as part of CRED platform, which offers to provide smart statements, payment reminders and more (don't miss out important FAQ at end of this post on what permission CRED protect needs and what it can access)

It helps track hidden bank charges along with outstanding balance, alerting for due date. The AI capability helps detect and warn potential suspicious transactions (based on Credit card statement). Recently they have even come up with an ultra cool feature to 'auto pay' your credit card bill using UPI. This is what their official claim is about autopay feature (refer to InApp screen captures below as well):

"choose your preferred date pending bill amount gets deducted from your bank account on the chosen date. we send WhatsApp reminders a day ahead"

But opting for above feature comes with a catch - you need to link your email accounts to provide access to bank statements and transaction mails. But to answer the question of does one really want it? It all depends on the number of credit cards you 'actively' own and use. If you have three or more (for those of us that that like to make the most of reward points based on spend/merchant category 😉 ) credit cards and using all of them on a monthly / regular basis then this could be the feature you might just need for monitoring and protecting all your credit card from a single point.

|

| CRED protect enabling screen |

"choose your preferred date pending bill amount gets deducted from your bank account on the chosen date. we send WhatsApp reminders a day ahead"

|

| auto-pay description screen |

But opting for above feature comes with a catch - you need to link your email accounts to provide access to bank statements and transaction mails. But to answer the question of does one really want it? It all depends on the number of credit cards you 'actively' own and use. If you have three or more (for those of us that that like to make the most of reward points based on spend/merchant category 😉 ) credit cards and using all of them on a monthly / regular basis then this could be the feature you might just need for monitoring and protecting all your credit card from a single point.

Everything that you need to know about "CRED Protect"

Are there any CRED protect charges ?

CRED protect is free, you will not be charged any fee for availing this feature from CRED platform.. on the contrary, this is a service designed to track hidden charges that may be levied by your bank.

What information do CRED access from my email & How secure is it ?

CRED claims to be deeply committed to protecting the personal information of members and works on the guiding principle of opt-In consent, full transparency and rock solid secure process, and technology implementations and regulatory compliance in how they access, store and use customer data. CRED protect which helps its members analyze their credit card statement and protects them from hidden fees and charges has been developed and is being managed with the same guiding principles.

To enable CRED protect a member is explicitly asked for permission to link their email and grant read-only access. This is necessary for retrieving credit card statements against each card which the member wants to manage using CRED protect. CRED does not access any other email other than statements for the credit card which the member has explicitly requested to be managed by CRED protect.

What security procedures does CRED follow ?

When CRED protect is opted-in, a securely developed "software applications" securely retrieves and analyzes card statements from emails. This application is deployed in an isolated network completely separated from the other CRED servers. No CRED employee, vendor or contractor is involved in this process or has access to this data. This is ensured by strict audit trails and approvals and the entire process has been audited, verified and validated by an external third party security auditor.

How secure is my data with CRED?

All industry best practices and standards have been implemented and continue to be improved upon for securing customer data which includes all data flow being TLS only. CRED uses HSM tokens and encryption both at application and database layers as well as encryption at REST. We have a regular key rotation policy. Any maintenance or upgrades of the application or to the servers hosting the application involve extensive audit trails and approval process. There are regular third party audits by recognized authors. CRED is firmly committed to protecting the safety of our customer data.

How can I contact CRED Customer care team?

Go through Contacting CRED customer Success team post for glimpse on channel available to get in touch with CRED customer care team.

No comments:

Post a Comment