What are the Charges for paying Rent on CRED ?

On CRED, paying your rent through credit card gives you access to numerous perks:

- Earn up to 3.3% extra reward points on your credit card

- Earn more CRED coins upon clearing your credit card bills

- Easy repayments with up to 45 days of credit period

- Reach your credit card annual fee waiver and reward milestones faster

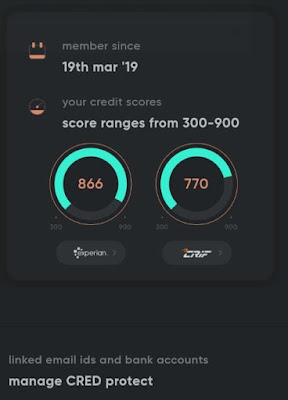

- Improve your credit score by paying back on time

However, keep in mind the below fine points as well:

- You can avail Rent Pay facility only once in a month

- If you try multiple transfer in a calendar month you will get "Monthly usage limit exceeded"

- You should provide the PAN card number of your land lord

- As per the IT act, it is mandatory to submit the landlord's PAN for rental payments above INR 50,000

- You thought you could use this as a hack to transfer money to your own account ? Gotcha! that is not gonna be possible..

- The Landlord's name you give should match with the back account details provided. If not you will get a "Landlord's name did not match the bank account details" error

Answers to some of the other frequent questions about CRED Rent payment feature:

Yes, all payments on CRED are encrypted and comply with the highest standards of security.

My account was debited but my payment has failed

CRED initiates an automatic refund in such rare cases. The money will get refunded back to you within 5-7 working days.

I paid rent through CRED but did not receive any CRED coins

Your rent payment would get added to your next credit card bill. Therefore, you will get more CRED coins when you make your next credit card bill payment on CRED.

Do I get a receipt after paying my rent?

Currently CRED is working on building an auto receipt feature for making your experience seamless. CRED will notify all our RentPay users with the update, as soon as it is launched. Thank you for your patience.

I am getting the error "Seems like you have entered your own PAN"

Please submit your landlord's PAN number in the space and retry

My payment has failed. When should I expect a refund?

CRED initiates a transfer as soon as a payment fails. In such rare cases, the money will be deposited into your method of payment within 5-7 working days.

To join CRED App with referral benefits (10 gems convertible to Amazon / Flipkart Gift voucher) visit:

https://credreferral.blogspot.com/2020/08/cred-referral-code.html